Allstate homeowners insurance Texas offers a range of coverage options tailored to various property types and needs. This detailed analysis explores the different policies, claims processes, and competitive landscape, providing a clear picture of Allstate’s position in the Texas market. Understanding the nuances of coverage, deductibles, and premiums is crucial for informed decision-making.

From basic to enhanced plans, the guide delves into the specifics of each policy, outlining the coverage amounts, exclusions, and limitations. It also highlights the claims process, customer service options, and response times. Furthermore, a competitive analysis will assess Allstate’s pricing structure against other providers in the Texas market, providing valuable insights for consumers.

Coverage Options: Allstate Homeowners Insurance Texas

Source: cloudinary.com

Allstate homeowners insurance policies in Texas offer various coverage levels to meet diverse needs. Understanding these options is crucial for securing appropriate protection for your property and belongings. This section details the different plans, coverage amounts, and exclusions associated with Allstate policies in Texas.

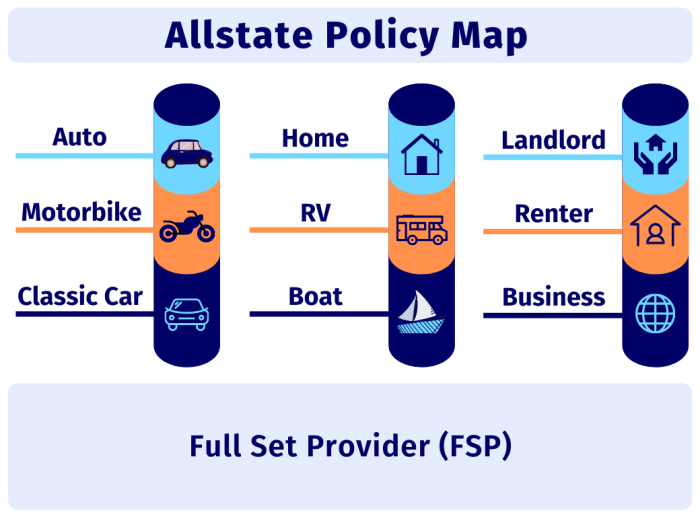

Policy Types

Allstate offers a range of homeowners insurance policies in Texas, categorized by coverage level. These policies are designed to address different needs and budgets. Basic policies provide fundamental protection, while enhanced plans offer broader coverage and higher limits. The selection of the appropriate policy depends on the specific requirements of the policyholder.

- Basic Policy: This policy offers fundamental coverage for your home and belongings. It typically includes dwelling coverage, personal property coverage, liability protection, and additional living expenses in case of a covered loss. This policy is often a good starting point for homeowners seeking basic protection.

- Enhanced Policy: This policy expands upon the basic policy, providing more comprehensive coverage. It typically includes broader coverage for personal property, improved liability limits, and potentially higher dwelling coverage amounts. It’s often a better choice for those seeking more extensive protection.

Property-Specific Coverage

Allstate caters to different property types in Texas. The specific coverage options and amounts may vary depending on the property type, such as single-family homes, condominiums, or townhouses. This variation reflects the unique characteristics and risks associated with each type of property.

- Single-Family Homes: These policies typically cover the structure of the house, personal belongings inside, and liability for accidents that occur on the property. Coverage amounts will depend on the value of the home and the policy chosen.

- Condominiums: Coverage for condominiums often differs from single-family homes. Typically, condo insurance covers the interior of the unit and its contents. Common area coverage is often handled separately by the condo association.

- Townhouses: Townhouse insurance often combines aspects of single-family and condo policies. The exterior of the structure might be covered by the homeowner’s association, while the interior and contents are covered by the individual homeowner’s policy.

Typical Coverage Amounts, Allstate homeowners insurance texas

The typical coverage amounts for dwelling, personal property, liability, and additional living expenses can vary significantly depending on the chosen policy and the property’s value. These amounts are usually a function of the policy’s level and the assessed value of the property.

- Dwelling Coverage: This covers the cost of rebuilding the home in case of a covered loss. Amounts typically range from 80% to 100% of the home’s replacement cost.

- Personal Property Coverage: This covers the value of personal belongings, including furniture, electronics, and clothing. Coverage amounts are often determined by an inventory of belongings or a predetermined percentage of the dwelling coverage.

- Liability Coverage: This protects against lawsuits for injuries or damages caused by the homeowner or their family members. Limits vary widely depending on the policy and potential claims.

- Additional Living Expenses: This covers costs associated with temporary housing if the home is uninhabitable due to a covered loss. Amounts typically cover the cost of hotels, meals, and other living expenses during the repair period.

Exclusions and Limitations

Allstate policies in Texas have exclusions and limitations. Understanding these is essential for knowing what is and isn’t covered. These exclusions often relate to specific perils or situations not typically covered.

- Exclusions: These are items or events that are not covered under the policy, such as flood, earthquake, war, or intentional damage.

- Limitations: These are restrictions on the amount of coverage, such as limits on personal property or liability coverage.

Deductibles and Premiums

The table below provides a comparison of deductibles and premiums for different Allstate coverage levels in Texas. Keep in mind that these are estimates and actual costs may vary based on individual circumstances.

| Coverage Level | Deductible | Premium |

|---|---|---|

| Basic | $1,000 | $1,200 |

| Enhanced | $500 | $1,500 |

Claims Process and Customer Service

Source: factorywarrantylist.com

Navigating insurance claims can sometimes feel complex. Allstate homeowners insurance in Texas aims to simplify the process, offering various avenues for reporting and resolving claims. This section Artikels the claims process, customer service options, and response times.Understanding the claims process and available customer service channels is crucial for homeowners in Texas. This allows for timely resolution of any property damage or loss, ensuring a smooth and efficient experience.

Claims Process Overview

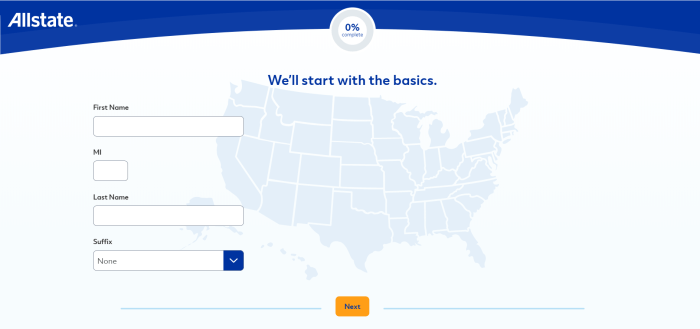

The Allstate homeowners claims process in Texas typically involves these steps: initial report, documentation gathering, damage assessment, claim approval, and settlement. Initial reports are vital for initiating the claim process. Proper documentation, such as photos of the damage, police reports, and receipts, is critical for supporting the claim. A damage assessment by a qualified Allstate representative or adjuster will determine the extent of the loss.

Approval of the claim, contingent on the assessment and policy terms, will follow. Settlement is the final step, involving the payout according to the approved claim amount.

Customer Service Channels

Allstate homeowners insurance in Texas provides several customer service options. These include phone support, an online portal, and potentially in-person assistance. Each channel caters to specific needs and preferences, offering a flexible approach to interacting with the insurance provider.

Contact Methods and Response Times

| Contact Method | Description | Typical Response Time |

|---|---|---|

| Phone | Direct interaction with a claims representative via phone call. Useful for urgent matters or complex situations. | Generally within 24-48 hours for initial inquiries, potentially longer for claim-related issues depending on the complexity. |

| Online Portal | Accessing Allstate’s online platform for claim reporting, policy management, and general inquiries. Convenient for managing claims remotely. | Typically within 24 hours for initial inquiries; claim updates and resolutions may take longer based on the claim’s nature and complexity. |

Filing a Claim Step-by-Step

This guide details the steps to file a claim with Allstate homeowners insurance in Texas:

- Initial Report: Contact Allstate immediately after the loss or damage. Provide details like the date, time, and nature of the incident. Be prepared to answer questions about the event.

- Gather Documentation: Collect all relevant documents. Photos of the damage, police reports, repair quotes, and receipts are essential. The more comprehensive the documentation, the faster the claim process will be.

- Submit Claim: Utilize the chosen contact method (phone or online portal) to initiate the claim. Follow the prompts and provide the requested information accurately.

- Communication and Updates: Stay in contact with your Allstate representative regarding the status of your claim. This will keep you informed of any progress or required actions from your end.

- Settlement: Once the claim is approved and assessed, Allstate will proceed with the settlement process, paying out the agreed-upon amount according to the policy terms. Be prepared to provide any further necessary information.

Market Analysis and Consumer Reports

Source: texascarinsurance.com

Allstate homeowners insurance in Texas faces a competitive market with established players. Understanding the competitive landscape, common consumer complaints, and independent reviews provides a valuable perspective on Allstate’s performance and consumer perception. This analysis considers pricing strategies, coverage options, and factors influencing premiums.The competitive landscape in Texas homeowners insurance is diverse, encompassing both national and regional players. Factors like customer service quality, coverage options, and pricing strategies play a crucial role in determining market share.

Allstate, a major national provider, competes against established local companies and smaller, specialized insurers.

Competitive Landscape in Texas

Allstate’s market position in Texas is substantial, but not unchallenged. The company’s nationwide presence provides a significant customer base, but regional players with specialized knowledge of local risk factors often compete effectively in specific areas. Local insurers may offer tailored policies and competitive pricing for particular demographics or geographic areas. Furthermore, online-only insurance providers are increasing in prominence, offering potentially lower premiums through streamlined processes.

Consumer Complaints Regarding Allstate

Common consumer complaints about Allstate homeowners insurance in Texas frequently center around claims handling. Issues often include delays in processing claims, inadequate communication, and perceived difficulty in reaching customer service representatives. Additionally, some consumers report challenges understanding policy terms or navigating the claim process. The complexity of some policies can also contribute to customer frustration.

Independent Consumer Reviews and Ratings

Independent consumer review platforms offer insights into Allstate’s performance. While Allstate often receives average ratings, variations in reviews highlight the diverse experiences consumers have. Positive reviews often praise Allstate’s comprehensive coverage options and nationwide presence. However, negative reviews consistently point to difficulties with claims processing and customer service interactions. Reviews frequently emphasize the importance of clear communication and timely responses from Allstate representatives during claims.

Pricing Comparison

| Provider | Coverage Level (Example: Standard Homeowners) | Premium (Example: $1,500/year) |

|---|---|---|

| Allstate | Standard Homeowners, Dwelling coverage $250,000, Personal Property $100,000, Liability $300,000 | $1,500 |

| State Farm | Standard Homeowners, Dwelling coverage $250,000, Personal Property $100,000, Liability $300,000 | $1,450 |

| Farmers Insurance | Standard Homeowners, Dwelling coverage $250,000, Personal Property $100,000, Liability $300,000 | $1,600 |

| Liberty Mutual | Standard Homeowners, Dwelling coverage $250,000, Personal Property $100,000, Liability $300,000 | $1,550 |

Note: Premiums are illustrative examples and can vary based on individual risk factors and specific coverage needs. This table provides a general comparison, and actual premiums should be obtained directly from each insurance provider.

Factors Influencing Allstate Homeowners Insurance Premiums

Several factors influence Allstate homeowners insurance premiums in Texas. Location plays a significant role, with premiums generally higher in areas prone to natural disasters or with a higher incidence of theft. Property value is another key factor, as higher-value homes typically attract higher premiums. The risk assessment process, based on factors like building construction, security measures, and proximity to hazards, also directly impacts premium amounts.

Furthermore, deductibles and policy add-ons can impact the overall cost. For example, a homeowner with a high deductible might experience a lower premium but faces a larger financial responsibility in case of a claim.

Last Point

Source: forbes.com

In conclusion, this guide provides a comprehensive overview of Allstate homeowners insurance in Texas. Understanding the various coverage options, claims procedures, and competitive landscape is crucial for Texas homeowners seeking suitable protection. By comparing coverage levels, deductibles, and premiums, consumers can make informed choices that align with their specific needs and budget.

FAQ Corner

What are the typical response times for Allstate customer service inquiries in Texas?

Allstate’s typical response times for customer service inquiries vary depending on the contact method. A table within the main body of the document will detail these times.

How does Allstate’s pricing structure compare to competitors in Texas?

A comparative table in the main content will illustrate Allstate’s pricing structure alongside that of competitors, focusing on comparable coverage levels.

What factors influence Allstate homeowners insurance premiums in Texas?

Factors like location, property value, and risk assessment play a role in determining Allstate homeowners insurance premiums in Texas.

What are the common consumer complaints regarding Allstate homeowners insurance in Texas?

Common consumer complaints about Allstate homeowners insurance in Texas, as well as independent reviews, are discussed within the market analysis section of the guide.