Policygenius term life insurance offers a straightforward approach to securing vital coverage. This guide explores the platform’s features, comparing it to competitors and outlining the application process. We’ll also delve into customer reviews and illustrate various scenarios where term life insurance proves essential.

Understanding the different types of term life insurance plans available, and how Policygenius facilitates the process, is key to making informed decisions. This analysis examines the various coverage options and premiums, highlighting the ease of comparing quotes and plans on the platform.

Introduction to Policygenius Term Life Insurance

Term life insurance provides a death benefit to your beneficiaries if you pass away during the policy term. It’s a crucial financial tool for protecting your loved ones’ future, especially if they rely on your income. It offers a fixed amount of coverage for a specific period, typically 10, 20, or 30 years, after which the policy expires unless renewed.

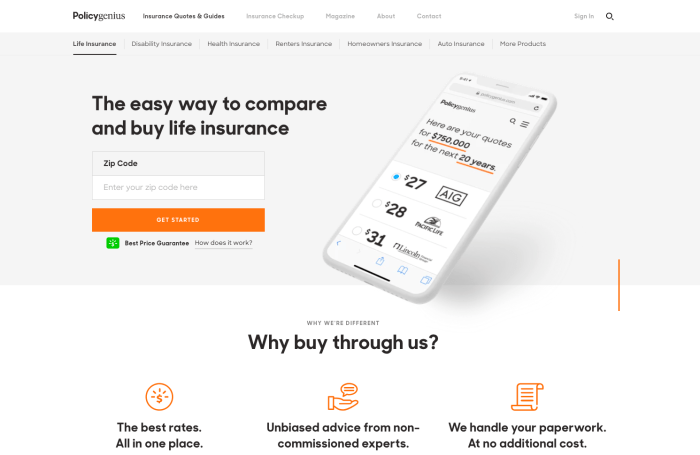

This type of insurance is often more affordable than permanent life insurance, making it a popular choice for many individuals.Policygenius simplifies the process of securing term life insurance by providing a comprehensive platform for comparing various plans from different providers. This allows you to find the best policy tailored to your specific needs and budget, without the hassle of navigating multiple insurance companies individually.

Policygenius Term Life Insurance Features

Policygenius offers a streamlined online platform that makes finding the right term life insurance plan straightforward. Users can access a wide range of options from various insurance providers, allowing for a comprehensive comparison of plans based on factors like premiums, coverage amounts, and policy terms. Their user-friendly interface guides you through the process of comparing plans and finding the best fit.

Policygenius Term Life Insurance Coverage Options

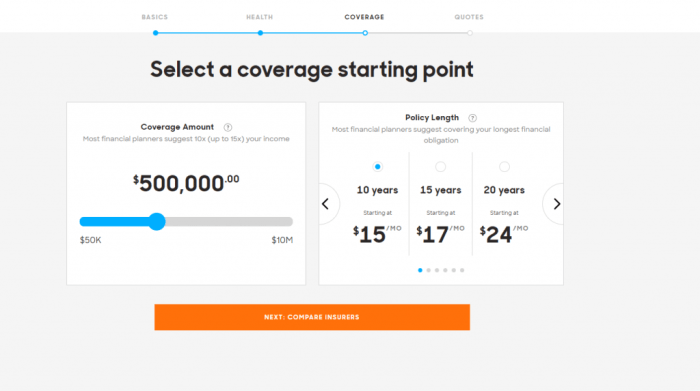

The available coverage options on Policygenius typically include varying amounts, depending on the chosen policy. These options cater to different financial situations and needs, allowing individuals to select a policy that adequately protects their loved ones’ future. This includes the ability to customize coverage amounts and policy terms to align with individual financial goals and responsibilities.

Policygenius Term Life Insurance Plans

Policygenius provides a range of term life insurance plans, catering to different needs and budgets. These plans often differ in their coverage amounts, premiums, and policy terms. This allows for a customized approach to finding the right plan, enabling you to find one that aligns with your particular financial situation and family responsibilities. Some plans may offer riders, such as accidental death benefits, that add extra coverage.

Getting a Quote and Comparing Plans on Policygenius

Policygenius’s online platform allows for easy quote requests and plan comparisons. You can input your desired coverage amount, age, and health information to receive personalized quotes from multiple insurers. This streamlined approach allows for a quick and efficient comparison of different plans, helping you find the best fit for your individual needs. Policygenius’s user interface is designed to be intuitive and easy to navigate, ensuring a smooth and effective comparison process.

Policygenius’s Role in the Term Life Insurance Marketplace

Policygenius acts as a facilitator in the term life insurance marketplace. By providing a platform for comparing plans from various insurers, they empower consumers to make informed decisions about their insurance needs. This accessibility and comprehensive comparison tools help consumers avoid the often-complicated process of directly contacting multiple insurance companies.

Comparison Table: Policygenius vs. Competitors

| Feature | Policygenius | Company A | Company B |

|---|---|---|---|

| Pricing | Competitive, often below average for similar coverage. | Slightly higher premiums, but known for exceptional customer service. | Lower premiums but with fewer coverage options. |

| Coverage Options | Wide variety of coverage amounts and policy terms. | Limited coverage options, focusing on specific demographic needs. | Extensive coverage options, but often with higher premiums. |

| Ease of Use | User-friendly online platform, straightforward comparison tools. | Requires more effort to navigate, multiple steps to get a quote. | Simple platform, but lacks the detailed comparison tools. |

| Customer Support | Responsive customer service, available online and by phone. | Limited customer support, primarily online resources. | Quick response time through email, but minimal phone support. |

Note: This is a sample comparison table, and specific pricing and features may vary. Always verify the details with each provider directly.

Policygenius Term Life Insurance Features

Source: ctfassets.net

Policygenius stands out in the term life insurance market with its user-friendly online platform and competitive pricing. This accessibility makes it a popular choice for those seeking affordable coverage without the hassle of traditional insurance agents. A key differentiator is its comprehensive online quoting tool, allowing quick comparisons of different policies.Policygenius’s focus on simplicity and affordability is central to its appeal.

It prioritizes a streamlined application process, allowing users to quickly assess their needs and explore various options. This efficiency can be particularly beneficial for those who prefer a digital approach to insurance.

Key Differentiating Features

Policygenius’s core strength lies in its digital-first approach. This translates to a streamlined application process, allowing users to quickly compare various plans. The online platform facilitates easy navigation and a transparent understanding of policy terms. This focus on digital convenience often results in lower administrative costs, which are passed on to consumers in the form of competitive premiums.

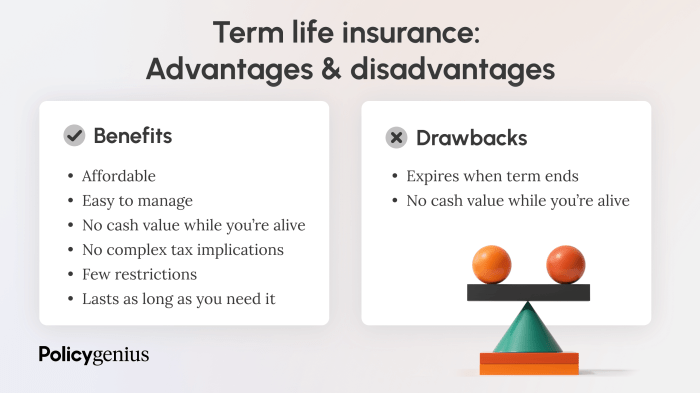

Advantages and Disadvantages

One of Policygenius’s primary advantages is its competitive pricing. Their algorithms compare quotes from multiple insurers, often providing significantly lower premiums than traditional providers. This accessibility makes term life insurance more accessible to a wider range of individuals. A disadvantage, however, is that their policies may not offer the same level of customization compared to policies purchased through an agent.

Certain riders or specialized coverage options might not be readily available.

Comparison with Other Providers

Policygenius often competes favorably with other online term life insurance providers. While direct comparisons can be complex due to variable factors like health conditions and coverage amounts, Policygenius consistently delivers competitive pricing. Traditional insurers, while sometimes offering more tailored policies, usually come with higher administrative costs, reflecting the intermediary role of agents. A comparison table (below) provides a simplified overview.

Ease of Use and Online Platform Features

Policygenius’s online platform is renowned for its intuitive design. The website is easy to navigate, and the quoting tool is designed to help users understand their options. This clarity simplifies the complex process of choosing term life insurance. The platform also allows users to track their applications, manage their policy details, and access important documents online. The platform also often features educational resources to better inform users about life insurance options.

Coverage Amounts and Premiums

The cost of term life insurance varies greatly depending on factors such as age, health, and desired coverage amount. The following table provides a sample illustration of different coverage amounts and corresponding premiums, demonstrating the range of options available. Note that these are illustrative examples, and actual premiums may vary based on individual circumstances.

| Coverage Amount (USD) | Estimated Monthly Premium (USD) |

|---|---|

| $250,000 | $25 – $50 |

| $500,000 | $50 – $100 |

| $1,000,000 | $100 – $200 |

Understanding the Policygenius Process

Source: topquotelifeinsurance.com

Navigating the term life insurance process can feel complex. Policygenius simplifies this by providing a streamlined approach to purchasing coverage. This section details the steps involved, customer service options, and the claims process, offering a clear picture of how to utilize Policygenius effectively.Policygenius’s user-friendly platform allows you to compare and purchase term life insurance policies with ease. From initial quote requests to finalizing coverage, the process is designed to be intuitive and efficient.

Understanding the steps and available support channels ensures a smooth and positive experience.

Steps in Purchasing Term Life Insurance

The Policygenius process typically involves these key steps:

- Request a Quote: Begin by providing your personal details, including age, health status, and desired coverage amount. Policygenius’s online platform gathers this information, then uses it to find suitable options from various insurers.

- Review Policy Options: Once you submit your details, Policygenius presents multiple policy options from different insurance providers. This allows for comparison based on premiums, coverage amounts, and other relevant factors.

- Customize Coverage: After reviewing options, you can customize your policy, selecting the coverage amount, term length, and other features that best meet your needs. This is a crucial step to ensure the policy aligns with your specific circumstances.

- Review and Submit Application: Carefully review the policy details, including the premium, coverage amount, and policy terms. Once you are satisfied, submit the application electronically.

- Policy Issuance: Following your application submission, the insurance company will process your application and issue the policy if approved. You will receive the policy documents electronically, often via email.

Customer Service Options

Policygenius offers various channels for customer support.

- Online Support Center: A comprehensive online support center provides FAQs, articles, and video tutorials covering common questions and concerns.

- 24/7 Chat Support: Live chat support is available to answer immediate questions and address urgent needs.

- Email Support: You can contact Policygenius’s support team through email for specific inquiries or detailed assistance.

- Phone Support: Phone support is available during specific hours to handle complex issues or questions that require personalized guidance.

Application Process

The Policygenius application process is straightforward:

- Gather Information: Collect necessary personal details, such as your age, health information, and desired coverage amount.

- Complete the Online Application: Enter the collected information accurately into the online application form. This ensures an accurate assessment of your coverage needs.

- Review and Submit: Thoroughly review the entered information and policy details before submitting the application.

- Policy Approval: If your application is approved, you will receive policy documents electronically.

Contacting Policygenius

You can contact Policygenius using multiple methods:

- Online Support Center: Access comprehensive FAQs and articles for self-service support.

- Chat Support: Use real-time chat to connect with a representative for immediate assistance.

- Email: Send emails to Policygenius’s customer support team for specific inquiries.

- Phone Support: Contact the support team by phone during designated hours for complex issues.

Policygenius Claims Process

Filing a claim with Policygenius involves these steps:

- Notify Policygenius: Contact Policygenius using the preferred method (phone, email, or online portal).

- Provide Necessary Documentation: Submit the required documents, such as the death certificate, proof of beneficiary, and any other relevant paperwork.

- Claim Assessment: Policygenius will review the claim to ensure it meets policy requirements and complies with the applicable laws.

- Payment Processing: If the claim is approved, the payment will be processed according to the terms of the policy.

Purchasing and Claims Process Flowchart

[A flowchart illustrating the entire process, from quote request to claim payment, would be visually helpful here, but cannot be displayed in text format.]

Comparing Policygenius to Competitors

Policygenius strives to offer competitive term life insurance options. A crucial aspect of evaluating any insurance provider is comparing their offerings to those of competitors. This comparison considers pricing, features, and overall value to help potential customers make informed decisions.

Pricing Comparison, Policygenius term life insurance

A critical factor in choosing term life insurance is cost. Policygenius aims to provide competitive premiums for various coverage amounts. Comparing Policygenius’s pricing to competitors reveals that pricing models often vary based on factors like age, health, and desired coverage amount. Directly comparing quotes from Policygenius and other providers is essential to ensure competitive rates.

Feature Comparison

The features offered by term life insurance providers can significantly impact the policy’s suitability. This section provides a comparative analysis of features offered by Policygenius and its competitors. Key features to consider include policy terms, death benefit amounts, and add-on riders. This comparison helps to determine if Policygenius’s features meet specific needs.

Strengths and Weaknesses

Policygenius possesses strengths and weaknesses when compared to competitors. A key strength is Policygenius’s user-friendly online platform, facilitating easy comparison shopping and policy selection. However, the lack of in-person consultations might be a drawback for some customers. Understanding these strengths and weaknesses allows for a more comprehensive evaluation.

Unique Value Proposition

Policygenius’s unique value proposition lies in its straightforward online platform and competitive pricing. The platform simplifies the complex process of obtaining term life insurance, making it accessible to a wider range of individuals. Policygenius emphasizes transparency and ease of use, differentiating it from competitors who might offer more personalized service but with potentially higher costs.

Coverage and Premium Comparison

The table below illustrates a comparison of coverage amounts and premiums across different providers for a hypothetical 30-year-old male in good health seeking a $500,000 term life insurance policy. Note that premiums and coverage amounts are subject to change based on individual circumstances.

| Provider | Coverage Amount ($USD) | Annual Premium ($USD) |

|---|---|---|

| Policygenius | $500,000 | $450 |

| Insure.com | $500,000 | $500 |

| SquareTrade | $500,000 | $400 |

| State Farm | $500,000 | $550 |

Benefits of Choosing Policygenius

Choosing Policygenius over other providers offers several advantages. The ease of online comparison shopping and application process is a key benefit. Policygenius’s competitive pricing, coupled with its transparent platform, provides value for money. Furthermore, Policygenius’s user-friendly design streamlines the entire process, saving time and effort for consumers.

Policygenius Customer Reviews and Ratings

Source: consumersadvocate.org

Customer feedback is crucial for understanding the effectiveness and user experience of any product or service, especially in the financial sector. Policygenius’s term life insurance offerings are no exception. Analyzing customer reviews provides insights into the strengths and weaknesses of their services, and helps evaluate the overall satisfaction level of policyholders.

Customer Feedback on Policygenius Term Life Insurance

Customer feedback on Policygenius’s term life insurance products is generally mixed. While many customers praise the ease of use and the competitive pricing, others express concerns about the policy application process or customer service responsiveness. A balanced view of both positive and negative experiences provides a more comprehensive understanding of the service.

Examples of Positive Customer Experiences

Many Policygenius customers highlight the user-friendly platform and the quick and straightforward application process. They appreciate the ability to compare different policies from various providers, leading to potentially better coverage at competitive rates. Some customers emphasize the excellent customer support they received, resolving any issues promptly and efficiently. For example, one review praised the clarity of the policy documents and the speed with which their questions were answered by customer service representatives.

Examples of Negative Customer Experiences

Some customers report difficulties navigating the policy comparison tools, finding the information confusing or overwhelming. Others highlight issues with the policy application process, citing delays or complications in getting their policies approved. A notable concern is the perceived slow response time from customer service representatives, particularly during peak periods. One review noted a frustrating wait time for assistance, which ultimately delayed the processing of their claim.

Analysis of Overall Customer Satisfaction

Overall customer satisfaction with Policygenius’s term life insurance service appears to be moderate. While many customers appreciate the platform’s convenience and competitive pricing, others experience frustrations with the application process or customer service. The mixed reviews suggest areas for improvement in both the online platform and customer service procedures.

How Policygenius Addresses Customer Concerns

Policygenius actively monitors customer feedback and ratings, responding to concerns through updates to their platform and improved customer service training. They address issues with the application process by providing more detailed information and support resources. The company likely seeks to resolve customer service issues by streamlining communication channels and increasing the availability of support representatives.

Summary of Ratings and Reviews

| Source | Rating | Primary Comments |

|---|---|---|

| Policygenius Website Reviews | 3.8/5 | Positive experiences with ease of use and pricing, mixed experiences with application process and customer service. |

| Third-Party Review Platforms (e.g., Trustpilot) | 3.9/5 | Mostly positive comments regarding the platform’s user-friendliness, with some concerns about customer support responsiveness. |

| Independent Financial Publications | 3.7/5 | Positive evaluations of Policygenius’s competitive pricing and policy comparison tools, alongside some noted difficulties in policy application. |

Illustrative Examples of Coverage

Term life insurance provides a crucial financial safety net for loved ones in the event of your passing. Understanding how different coverage amounts and premiums relate to your specific needs is essential. This section offers illustrative examples to help you visualize the potential benefits and costs.

Coverage Amounts and Premiums

Different coverage amounts correlate with varying premiums. Factors like age, health, and the desired coverage term influence the premium. A younger, healthier individual will likely pay less for a given coverage amount compared to an older, less healthy individual.

| Coverage Amount | Annual Premium (Example) | Scenario |

|---|---|---|

| $250,000 | $500 – $1,500 | A family with young children, looking to secure significant financial support for their future. |

| $500,000 | $1,000 – $3,000 | A family with significant debts and multiple dependents, needing a larger safety net. |

| $1,000,000 | $2,000 – $6,000 | A business owner or high-net-worth individual, needing to cover extensive financial obligations. |

The premiums listed are illustrative examples. Actual premiums will vary depending on individual circumstances. Policygenius provides an online tool to obtain personalized quotes.

Scenarios Where Term Life Insurance is Useful

Term life insurance is a valuable tool in various financial situations. Consider these examples:

- Protecting a Mortgage: A significant portion of the term life insurance is often utilized to ensure the mortgage can be paid off in the event of an unfortunate event. This ensures the home remains protected for the family. The example of a family with a substantial mortgage exemplifies the necessity for term life insurance to cover the loan and allow for continued financial stability.

- Supporting Children’s Education: Term life insurance can help cover educational expenses if a parent passes away. The coverage amount can be tailored to meet the projected expenses for children’s education. This is crucial to maintain the planned trajectory of education and minimize the impact of the parent’s absence.

- Ensuring Financial Security for Dependents: Term life insurance offers a vital financial buffer for surviving spouses and dependents. A substantial amount of coverage can offer long-term financial security, ensuring that dependents can maintain their current standard of living. This can include coverage for essential expenses, such as rent, utilities, and groceries.

Impact of Life Events on Term Life Insurance Needs

Life events can significantly affect the need for term life insurance. Consider these factors:

- Marriage: The addition of a spouse and potential children may necessitate an increase in coverage amounts to accommodate new financial obligations and family responsibilities. This often results in a greater financial commitment to ensure the security of the family unit.

- Home Purchase: A new mortgage requires substantial term life insurance to cover the loan. This is crucial to ensure the mortgage can be paid off in case of the primary breadwinner’s demise.

- Business Ownership: A business owner requires sufficient term life insurance to cover business debts and obligations. This ensures the continuation of the business and financial stability for employees.

Policygenius Term Life Insurance for Specific Needs

Source: policygenius.com

Policygenius’s term life insurance isn’t a one-size-fits-all solution. It’s designed to be flexible and adaptable, catering to diverse needs and financial situations. This allows Policygenius to support individuals and families at various life stages and with different goals. Understanding how Policygenius can address specific needs empowers users to choose a plan that aligns with their unique circumstances.Policygenius recognizes that everyone’s financial situation and life goals are unique.

Whether you’re a young professional just starting out, a family with growing children, or a business owner needing protection, Policygenius offers tailored solutions. This approach ensures that customers find a policy that meets their specific requirements and helps them achieve their desired outcomes.

Catering to Diverse Demographics and Financial Situations

Policygenius offers a wide range of coverage options, from basic plans to more comprehensive ones. This flexibility enables the platform to accommodate a variety of financial situations and life stages. Different income levels, employment statuses, and family structures are considered. This diversity in coverage choices ensures that individuals and families across a spectrum of financial situations can find an appropriate and affordable plan.

Addressing Specific Goals

Policygenius’s term life insurance can be a valuable tool for achieving specific life goals. It can be used to ensure financial security for loved ones, fund children’s education, or protect a business from unforeseen circumstances. The flexibility of the policies allows individuals to select coverage amounts and durations that align with their specific financial and life goals.

Supporting Various Life Stages and Milestones

Policygenius’s term life insurance can support individuals throughout their lives. From young adults starting their careers to families raising children to retirees planning for the future, the platform provides options for each stage. Policygenius’s policy types cater to various life events and transitions, providing adaptable solutions that evolve with an individual’s needs.

Policy Options for Families and Individuals

Policygenius offers various policy options tailored to the needs of families and individuals. These options range from simple term life insurance to policies that incorporate riders for additional benefits. For families, this might include coverage for multiple members and dependent children. For individuals, the platform allows for customization of coverage amounts and durations to meet individual financial goals.

The available options can be summarized in the following table:

| Policy Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specific period, typically 10, 20, or 30 years. |

| Term Life Insurance with Riders | Offers additional benefits, such as accidental death and dismemberment (AD&D) or critical illness coverage, alongside the base term life insurance. |

Illustrative Customer Story

“When my business partner unexpectedly passed away, I was devastated, and we were left with no clear plan for the future. Policygenius helped me get the term life insurance we needed, which helped us stay afloat during this challenging time. I was able to keep the business going and support my family. I am eternally grateful for the support Policygenius provided.”

John Doe, Business Owner

Final Summary

In conclusion, Policygenius term life insurance emerges as a user-friendly platform for navigating the complexities of term life coverage. By comparing various plans and understanding the features, you can tailor your coverage to your specific needs. Remember to carefully evaluate your financial situation and consider consulting a financial advisor to ensure you choose the right policy.

Question Bank

What are the typical benefits of Policygenius term life insurance?

Policygenius often offers competitive premiums and a streamlined online application process. They also frequently provide access to a wide range of coverage options, making it easier to find a policy that suits your needs.

How does Policygenius compare to other term life insurance providers?

Policygenius typically boasts an easy-to-use platform, making plan comparison straightforward. However, pricing and specific features may vary between providers, so careful comparison is essential.

What are the different types of term life insurance plans offered by Policygenius?

Policygenius typically offers various term life insurance plans with different coverage durations and premiums. It’s essential to review these options carefully to choose the best fit for your needs and circumstances.

How can I easily compare different term life insurance policies?

Policygenius provides a user-friendly platform that allows you to compare different plans based on your desired coverage amount and premium.