Car insurance texas compare – Comparing car insurance Texas is crucial for finding the best deal. Different companies offer varying policies, and understanding the specifics is key. This guide delves into various aspects of Texas car insurance, from coverage types and pricing models to the essential laws and regulations.

This comprehensive guide will equip you with the knowledge to effectively compare car insurance in Texas. We’ll analyze pricing strategies, highlight discounts, and break down the complexities of Texas insurance regulations, all in an easy-to-understand format.

Car Insurance Comparison in Texas

Source: carinsurance.org

Comparing car insurance quotes in Texas is crucial for finding the most suitable coverage at the best price. Understanding the various factors influencing premiums and the types of coverage available empowers consumers to make informed decisions. A comprehensive understanding of insurance companies operating in the state and their reputations further refines the selection process.Texas car insurance regulations mandate certain coverages, but consumers can tailor their policies to their individual needs and financial situations.

This involves careful evaluation of the various coverage options and a thorough comparison of quotes from different insurance providers. Choosing the right policy safeguards against financial burdens in the event of an accident.

Key Factors for Comparing Quotes

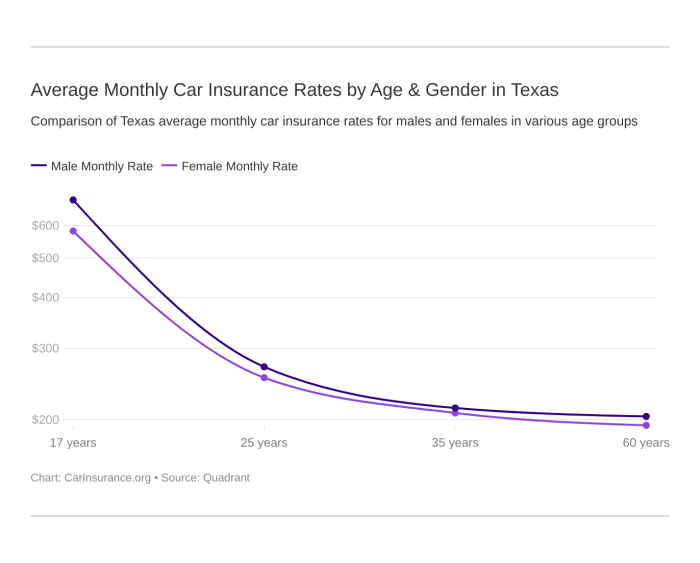

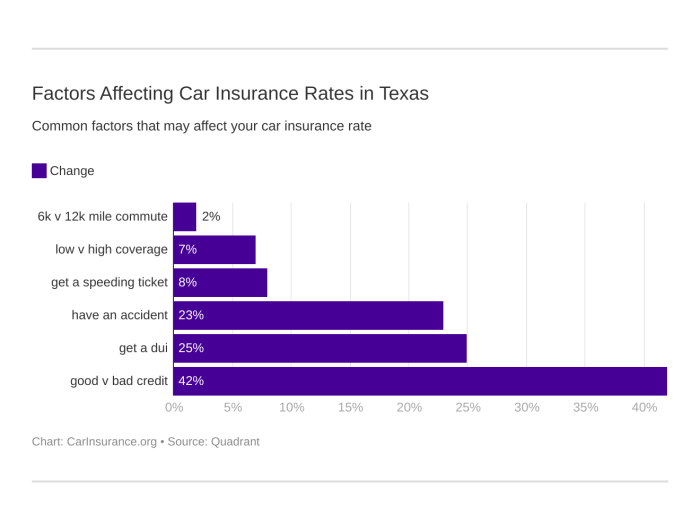

Texas car insurance rates are influenced by several factors. These include driving history, vehicle type, location, and personal details like age and gender. Analyzing these factors is essential for obtaining accurate and relevant quotes. By understanding these influences, consumers can make informed decisions about their coverage.

Types of Car Insurance Coverage

Texas requires specific minimum coverage levels. These fundamental coverages include:

- Liability Coverage: This protects you if you cause an accident and are legally responsible for damages to another person or their property. It covers the other driver’s medical expenses and vehicle repairs, up to the policy limits.

- Collision Coverage: This pays for damages to your vehicle regardless of who is at fault. It’s particularly important if you have a newer vehicle.

- Comprehensive Coverage: This covers damages to your vehicle from incidents other than collisions, such as hail, fire, theft, or vandalism. Comprehensive coverage is a crucial component of protecting your investment.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or whose insurance is insufficient to cover your damages. It’s essential for safeguarding against financial losses from accidents involving uninsured or underinsured drivers.

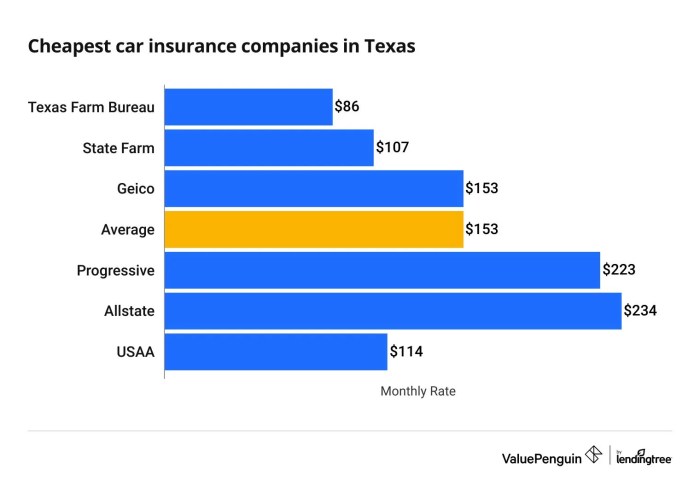

Insurance Companies in Texas

Numerous insurance companies operate in Texas. Factors like customer service, claim handling, and financial stability should be considered when selecting a provider. Researching company reputations and handling of past claims can provide valuable insights into their approach.

Comparison of Popular Insurance Companies

Evaluating pricing models, discounts, and customer reviews provides a more precise understanding of insurance company performance.

| Company | Pricing Model | Discounts | Customer Reviews |

|---|---|---|---|

| Example Company 1 | Generally competitive rates, with a focus on bundling options | Discounts for safe driving, good credit history, and multi-vehicle policies | Generally positive reviews regarding customer service and quick claim processing. |

| Example Company 2 | Premiums based on risk assessment and driving data. | Discounts for anti-theft devices, accident prevention programs, and multi-policy holders. | Mixed reviews, with some customers reporting long claim processing times. |

| Example Company 3 | Transparent pricing structure, often with online tools for comparing quotes. | Discounts for vehicle safety features, good student status, and long-term policyholders. | Positive reviews for straightforward online processes, but customer service may be perceived as less personalized. |

Finding Affordable Car Insurance in Texas

Source: youngamericainsurance.net

Securing affordable car insurance in Texas is a crucial aspect of responsible vehicle ownership. Navigating the complexities of various coverage options and discounts can be challenging, but understanding key strategies can significantly reduce premiums. This section will explore effective methods to find the best possible rates while maintaining adequate coverage.Finding the right car insurance policy in Texas often involves a combination of careful comparison shopping, understanding coverage options, and maximizing available discounts.

By utilizing these strategies, drivers can achieve a balance between financial responsibility and cost-effective protection.

Common Strategies for Finding Affordable Car Insurance

Several strategies can help Texans find affordable car insurance. Bundling policies, using comparison tools, and evaluating discounts are all effective methods. Bundling, for example, can lead to significant savings when combining multiple policies, such as homeowners or renters insurance, with auto insurance. This strategy can prove particularly advantageous.

Using Comparison Tools

Insurance comparison websites are invaluable resources. These tools allow drivers to quickly compare quotes from various providers, facilitating a more informed decision-making process. They often offer detailed breakdowns of coverage options and associated costs, which can assist in identifying suitable plans that align with individual needs and budget constraints. By comparing quotes from multiple providers, drivers can easily identify the most competitive rates available.

Evaluating Discounts

Many insurance companies offer various discounts. Drivers should explore these options diligently to potentially lower their premiums. Some common discounts include those for safe driving habits, vehicle anti-theft features, and good student status.

Coverage Levels and Premium Impacts

Different coverage levels have varying impacts on premiums. Liability-only policies generally have the lowest premiums, but offer the least protection. Comprehensive and collision coverage provide broader protection, resulting in higher premiums, though often crucial for complete financial security. The optimal coverage level is determined by individual risk tolerance and financial situation.

Factors Affecting Car Insurance Rates in Texas

Several factors influence car insurance rates in Texas. Driving history, vehicle type, and location all play significant roles. A clean driving record typically translates to lower premiums, while accidents or traffic violations can increase rates. The type of vehicle, including its make, model, and year, can also affect premiums. Location is another critical factor, as rates often vary based on factors such as crime rates and traffic density.

Specific Discounts and Maximization

Texas insurance providers offer various discounts, each with the potential to lower premiums. Some popular discounts include discounts for good students, safe drivers, and anti-theft devices. Drivers should proactively seek out and utilize these discounts to maximize savings.

Insurance Discounts and Potential Savings

| Discount Type | Description | Potential Savings |

|---|---|---|

| Good Student Discount | Available for students maintaining a good academic record. | Potentially 10-20% or more. |

| Defensive Driving Course Discount | Completion of a defensive driving course. | Potentially 5-15% or more. |

| Anti-theft Device Discount | Installation of approved anti-theft devices. | Potentially 5-10% or more. |

Understanding Texas Car Insurance Laws and Regulations

Source: carinsurance.org

Navigating the world of car insurance can be complex, especially with varying state regulations. This section provides a comprehensive overview of Texas car insurance laws, helping you understand your responsibilities and rights as a policyholder.Texas insurance laws are designed to ensure a degree of financial protection for those involved in accidents. Knowing these laws empowers you to make informed decisions about your coverage and helps you understand the process of filing claims.

Minimum Insurance Requirements, Car insurance texas compare

Texas mandates specific minimum insurance coverage levels to protect drivers and other road users. Failure to meet these requirements can result in penalties. These requirements include liability coverage, which protects you from financial responsibility in the event of an accident where you are at fault.

- Bodily injury liability (BIL): Texas requires a minimum of $30,000 per person and $60,000 per accident for bodily injury liability. This coverage pays for medical expenses and lost wages for those injured in an accident where you are at fault. For example, if a driver causes a collision resulting in $50,000 in medical bills for the injured party, their BIL coverage will cover the expenses up to the policy limit.

- Property damage liability (PDL): Texas mandates a minimum of $25,000 in property damage liability. This coverage compensates the other party for damages to their vehicle in an accident where you are at fault. A collision causing $30,000 in damage to the other vehicle would be covered up to the policy limit under this type of coverage.

Claim Filing Process

Understanding the claim filing process is crucial in case of an accident. The following steps Artikel the typical procedure.

| Claim Stage | Description | Required Documents |

|---|---|---|

| Reporting the Accident | Immediately report the accident to the police, regardless of the severity. Obtain a police report. | Police report, witness statements (if available) |

| Contacting Your Insurance Company | Contact your insurance company to notify them of the claim and begin the claim process. | Policy details, insurance ID, and any relevant information about the accident. |

| Gathering Documentation | Collect all relevant documents, including medical bills, repair estimates, and witness statements. | Medical bills, repair estimates, photos of damage, witness statements. |

| Claim Investigation | Insurance company investigates the claim, including assessing the validity and extent of the damage. | All collected documentation. |

| Claim Settlement | The insurance company determines the settlement amount and proceeds with the payment. | Agreed settlement amount, proof of payment, etc. |

Types of Texas Insurance Policies

Texas offers various insurance policy types, each with distinct coverage options. Understanding these options allows policyholders to choose a policy that aligns with their needs and budget.

- Liability Coverage: This type of coverage only pays for damages caused to others in an accident you are at fault. It does not cover your vehicle or your own medical expenses.

- Collision Coverage: This pays for damages to your vehicle regardless of who is at fault in the accident. It protects your investment in your car.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than a collision, such as vandalism, theft, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have car insurance or does not have enough coverage to fully compensate you for your damages. This is crucial in ensuring you are protected against potentially financially devastating situations.

Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a critical role in regulating insurance companies within the state. They ensure that insurance companies operate fairly and transparently. Their oversight protects consumers from fraudulent or predatory practices.

Last Point

Source: cloudinary.com

In conclusion, comparing car insurance in Texas requires careful consideration of coverage options, pricing models, and company reputations. By utilizing comparison tools, understanding discounts, and being informed about Texas insurance laws, you can find an affordable and suitable policy. Remember to thoroughly evaluate your needs and preferences before making a decision.

FAQ Summary: Car Insurance Texas Compare

What are the most common discounts available for car insurance in Texas?

Common discounts include those for safe driving records, bundling policies (e.g., combining car and home insurance), anti-theft devices, and good student status. Many insurers also offer discounts for certain vehicle types or for maintaining a specific safety rating.

What are the minimum insurance requirements for drivers in Texas?

Texas law mandates a minimum amount of liability coverage. Policyholders must meet specific minimum requirements for bodily injury liability and property damage liability. Check the Texas Department of Insurance website for the most up-to-date requirements.

How can I file a car insurance claim in Texas?

Filing a claim in Texas involves reporting the accident to the police, gathering necessary documentation (e.g., police report, medical records), and then notifying your insurance company. The exact process varies slightly between insurers, but generally involves submitting a claim form and providing supporting documents.

How do I find reliable customer reviews for car insurance companies in Texas?

Review websites like Yelp, Trustpilot, and Better Business Bureau often feature consumer reviews about insurance companies. You can also check the Texas Department of Insurance website for complaints and ratings, though keep in mind reviews can be subjective.