In today’s competitive financial landscape, managing client relationships effectively is paramount for success. Financial advisor CRM software offers a powerful solution, streamlining operations and boosting productivity. This comprehensive guide delves into the intricacies of financial advisor CRM software, exploring its features, benefits, selection criteria, and frequently asked questions.

Source: revopsteam.com

Understanding Financial Advisor CRM Software

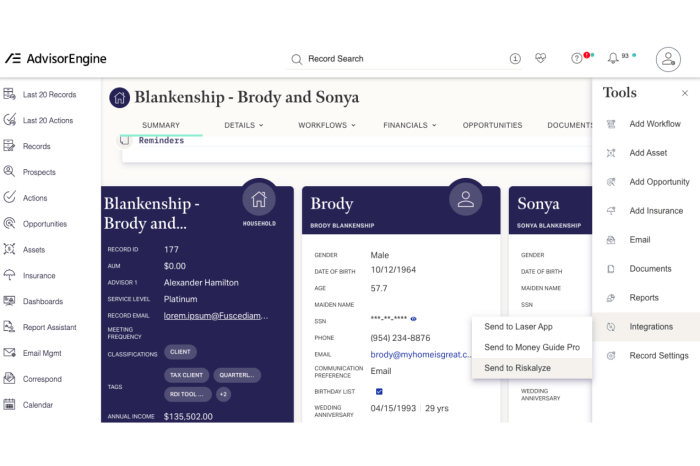

Financial advisor CRM (Customer Relationship Management) software is a specialized tool designed to manage all aspects of client interactions within the financial advisory industry. It goes beyond basic contact management, providing features tailored to the unique needs of financial advisors, including portfolio tracking, client communication, compliance management, and reporting capabilities. These systems are crucial for building stronger client relationships, improving efficiency, and ultimately, growing your business.

Key Features of Financial Advisor CRM Software

- Contact Management: Centralized database for storing client information, including contact details, financial profiles, and interaction history.

- Client Portfolio Management: Track client assets, investments, and performance metrics, providing a holistic view of each client’s financial situation.

- Communication Management: Facilitate seamless communication with clients through email, phone calls, and secure messaging, maintaining a detailed record of all interactions.

- Document Management: Securely store and manage important client documents, ensuring easy access and compliance with regulatory requirements. This often includes features for e-signature capabilities.

- Workflow Automation: Automate repetitive tasks, such as appointment scheduling, follow-up emails, and report generation, freeing up valuable time.

- Reporting and Analytics: Generate insightful reports on client performance, revenue, and other key metrics to inform business decisions and track progress.

- Compliance Management: Ensure adherence to regulatory requirements, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, through built-in compliance features.

- Integration Capabilities: Integrate with other essential tools, such as accounting software, portfolio management systems, and marketing automation platforms, for a streamlined workflow.

- Client Onboarding: Streamline the client onboarding process with automated workflows and digital forms, reducing manual effort and improving efficiency.

- Performance Reporting: Generate customizable reports showcasing client portfolio performance, highlighting key metrics and trends for both the advisor and the client.

Benefits of Using Financial Advisor CRM Software

Implementing a robust CRM system offers numerous benefits for financial advisors:

- Improved Client Relationships: Personalized communication and proactive engagement lead to stronger client relationships and increased loyalty.

- Increased Efficiency: Automation of tasks frees up time for strategic activities, such as client acquisition and financial planning.

- Enhanced Productivity: Streamlined workflows and centralized information improve overall productivity and reduce administrative burden.

- Better Compliance: Built-in compliance features help ensure adherence to regulatory requirements, minimizing risk.

- Data-Driven Decision Making: Access to comprehensive data and insightful reports enables informed decision-making.

- Scalability: CRM systems can adapt to the growth of your business, accommodating increasing client numbers and complexity.

- Improved Client Retention: Proactive communication and personalized service contribute to higher client retention rates.

- Increased Revenue: Improved efficiency and client satisfaction can directly translate into increased revenue.

Choosing the Right Financial Advisor CRM Software

Selecting the appropriate CRM software requires careful consideration of several factors:

- Business Needs: Assess your specific needs and requirements, considering the size of your firm, the number of clients, and the complexity of your operations.

- Features and Functionality: Choose a system that offers the essential features Artikeld above, including those relevant to your specific advisory niche.

- Integration Capabilities: Ensure compatibility with your existing software and tools.

- Scalability: Select a system that can accommodate your future growth and expansion.

- Cost and Pricing: Consider the overall cost of the software, including licensing fees, implementation costs, and ongoing maintenance.

- User-Friendliness: Opt for a user-friendly interface that is easy to navigate and learn.

- Customer Support: Ensure that the vendor provides reliable customer support and training.

- Security and Compliance: Verify that the system meets industry security and compliance standards.

Frequently Asked Questions (FAQ): Financial Advisor Crm Software

- Q: What is the cost of financial advisor CRM software? A: The cost varies widely depending on the features, vendor, and number of users. Expect to find options ranging from affordable monthly subscriptions to more expensive enterprise-level solutions. Many vendors offer free trials or demos to help you evaluate options.

- Q: How long does it take to implement financial advisor CRM software? A: Implementation time varies depending on the complexity of the system and the size of your firm. It can range from a few weeks to several months. Proper planning and training are crucial for a smooth implementation.

- Q: Can I integrate my existing software with a financial advisor CRM? A: Many CRM systems offer robust integration capabilities with various software, including accounting software, portfolio management systems, and marketing automation platforms. Check the vendor’s specifications to ensure compatibility.

- Q: What are the key security features to look for in a financial advisor CRM? A: Look for features such as data encryption, access controls, audit trails, and regular security updates to protect sensitive client data. Compliance with regulations like GDPR and CCPA is also vital.

- Q: What are some examples of popular financial advisor CRM software? A: Several reputable providers exist, including Redtail CRM, Salesforce Financial Services Cloud, Wealthbox, and many others. Researching various options to find the best fit for your specific needs is recommended.

Conclusion

Financial advisor CRM software is an invaluable tool for enhancing efficiency, improving client relationships, and driving business growth. By carefully considering your needs and selecting the right system, you can leverage the power of CRM to elevate your financial advisory practice to new heights. Investing in a robust CRM is an investment in the future of your business.

References:

Ready to transform your financial advisory practice? Contact us today for a free consultation!

Helpful Answers

What are the key features to look for in financial advisor CRM software?

Key features include client relationship management (contact details, interaction history), task automation (appointment scheduling, follow-ups), reporting and analytics (performance tracking, client segmentation), and integration with other financial tools.

Source: soloway.tech

How much does financial advisor CRM software typically cost?

Pricing varies widely depending on features, scalability, and vendor. Expect monthly subscription fees ranging from basic plans to enterprise-level solutions with customized pricing.

How can I ensure data security with my CRM software?

Source: engagebay.com

Choose a vendor with robust security protocols, including encryption, data backups, and compliance with relevant regulations like GDPR or HIPAA. Review their security policies carefully before implementation.

What is the learning curve for using financial advisor CRM software?

The learning curve varies depending on the software’s complexity and user-friendliness. Many vendors offer training resources and support to help users get started. Look for intuitive interfaces and helpful documentation.